If it isn't going to work, just shut it down.

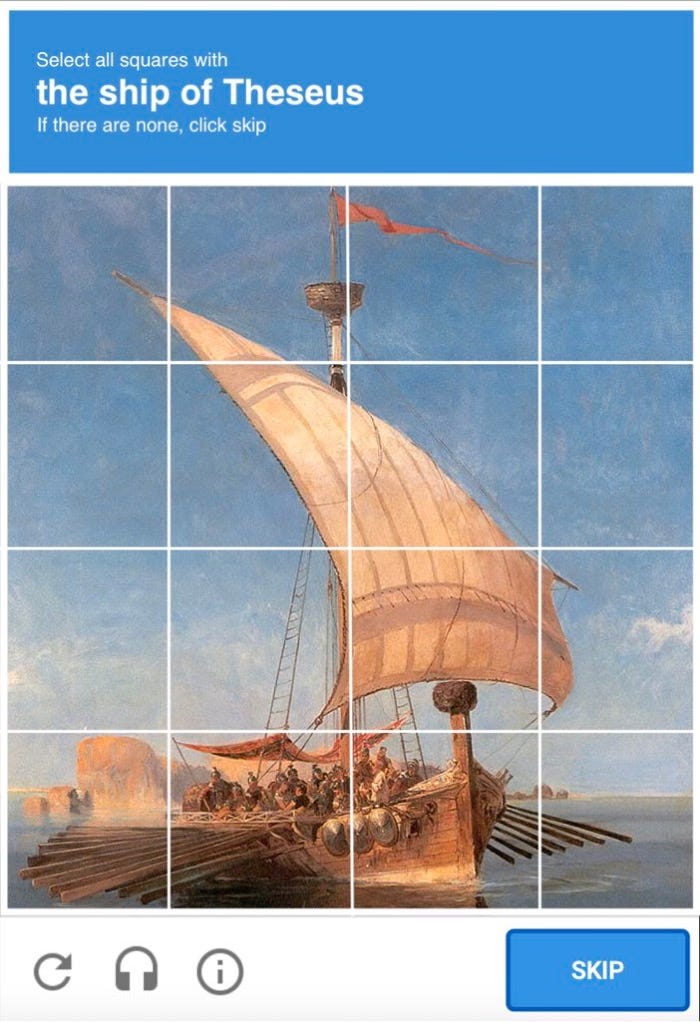

Don’t build the startup ship of Theseus.

The Series A crunch we’re seeing right now - companies can’t get funded or don’t want to raise, investors are wary of price discovery, and things that seemed like sure bets at the seed in a time of loose capital are now sweating bullets - is going to lead to some tough choices for seed founders and investors. Founders will leave, companies will raise down-rounds, cap tables will get broken.

For almost all of them, it won’t be worth it. When things get really messy for seed companies, it’s almost always already a lost cause.

Seed companies are labs and your investors (explicitly or otherwise) have signed up for a limited set of experiments in the pursuit of a viable business. Same goes for your employees. They shouldn’t go through down-rounds, cap table restructurings, multiple major pivots, or team transitions. After all that, is it even the same company? No. They should just shut down and start over.

As a founder, you wind up risking your own reputation and more capital from new investors (and any cash left in the company that you could return to your existing investors) by keeping something alive through continued life support and unnatural corporate contortions. Worse, you risk your own time and brain damage.

Founders often want to “reward” their early investors and find salvage value while investors see major pivots and restructurings as leaving them with free “option value.” Because who knows, maybe this will work! Investors love pushing pivots onto companies because in theory the logic holds up. In practice it doesn’t and isn’t worth the effort. When things get into messy founder situations or broken cap tables without having a business that obviously works or a product that is obviously great, you’re just tying up a team for something that will likely go nowhere.

“Bringing people along” (rolling over your employees and investors) into what is effectively a new company rather than just simply starting clean is a waste of time, effort, energy and money with little upside. The real way for investors to support founders and preserve cheap option value and for founders to reward early backers is to shut down and raise anew. Keep the team together and keep the relationships intact.

Down-rounds, cap table restructurings, ceo transitions, etc. before there is a real, viable business with significant and demonstrable enterprise value is just tilting at windmills. Or, to mix metaphors metaphors, don’t build the startup ship of Theseus.

Thanks to John Neamonitis and Will Quist for feedback and suggestions.