Self driving software and the end of Git

Plus the end of Git, long Moderna, PE as sin eaters in the capital markets

This was an exciting week in that I had two different companies I’m really fired up about come out of stealth and announce their funding. Phoebe and Atomic both launched to the public on Wednesday. These are two of the three companies I linked to before in my hiring post from December.

Phoebe’s seed round: $9.5M for the self-driving network of agents to fix healthcare labor

America is getting older and sicker. Our economy is becoming a great national nursing home and we must do everything possible to rein in costs. That’s why care is moving from hospitals to the home whenever it can. Now home care is the fastest growing job in America: 4 million workers and $160B in spend.

Despite big dollars, it’s a cottage industry that struggles under the weight of high churn, low margins, human memory, and manual coordination on every side: labor, families, and agencies. This is endemic to/emblematic of healthcare staffing overall.

And it’s about to get worse as AI floods the zone with undifferentiated outreach and spam. The scarce resource in this market isn’t jobs or caregivers, per se. Instead, it’s attention: which shift a worker sees, responds to, and chooses.

Phoebe is built to aggregate and direct worker attention.

Phoebe replaces the coordinators inside every home care agency with agents that never sleep, never churn, and never forget: turning unstructured data into rich, enduring memory and a system of action. From there, it’s expanding outwards with a talent agent for caregivers that acts on their behalf and eventually a care advisor for families.

Phoebe is a new kind of company: a self-driving network of agents. Just like the internet enabling marketplaces and mobile enabling on-demand services, large language models now make it possible to embed agents directly into workflows. Phoebe doesn’t sell tools to operators or become the operator itself. It distributes a better playbook through autonomous agents that run inside existing infrastructure with zero behavior change or new tooling.

Phoebe is a network of agents that builds memory, identity, messaging, and payments as the connective tissue of the home care market.

Thousands of shifts across thousands of workers already move through Phoebe every day. Agencies are reallocating headcount and increasing margins. Workers are making more money. Families are getting better care. This is happening now.

We partnered with Phoebe CEO Justin Woodbridge at inception and we’re thrilled to double down in the seed round. Phoebe has now raised ≈$10M in total with their $7.4M seed round led by Michael Bloch at Quiet Capital with participation from Slow, Moxxie, Roar Ventures, Consonant, and Gokul Rajaram. It’s a killer crew around one of the most forward-looking agent-native platforms we’ve seen.

Justin is an incredibly gifted founder with vision, technical ability, and a competitive drive to win at every level. Phoebe is in-office in NYC and hiring across engineering, sales, operations, and design. If you believe that software should coordinate the real world check out phoebe.work/about.

LLMs/codegen are breaking Git. Atomic comes next.

Linus Torvalds created Git in 2005 because the existing tools couldn’t handle Linux’s scale. Git replaced CVS when distributed workflows became the norm.

Twenty years later, LLMs/codegen are re-running the cycle again and breaking Git

Git was built for a world where code is scarce and human attention is abundant. That model is flipping: human attention is now scarce, code is abundant. The mismatch creates friction everywhere: agents breaking CI, attribution nightmares, security models that assume human review.

Atomic is building version control for agent-native development.

The core idea: changes matter more than files. Instead of opaque snapshots, Atomic records changes as atomic, cryptographically verifiable units with explicit provenance and institutional knowledge. Every change is inspectable, attributable, auditable, and composable.

Atomic founder/CEO Lee Faus can see this problem and solve it. He’s a core contributor to Git itself and spent years at both GitHub and GitLab, building and selling developer infrastructure to the largest enterprises in the world. Deep technical credibility plus real enterprise relationships: an N-of-one profile to meet the moment.

We’re thrilled to partner with Lee alongside Ashley Smith (fmr VP Marketing at GitHub, CMO at GitLab) and Jean Sini.

The team is building in the open: explore the projects at github.com/atomicdotdev/atomic and github.com/atomicdotdev/circuit-breaker.

Long Moderna

Moderna’s stock which has basically been in free fall and a crab walk since the pandemic popped earlier this week on news of a positive result from a skin cancer vaccine trial.

Moderna is one of only three individual names I have bought in the public markets over the last couple of years. (Unfortunately it is the smallest position of those three)

My view has been that it’s just extremely unlikely that they would build this hugely valuable technology that would only work on one thing (COVID) and only one time (when it was most needed). That is a very unlikely combination of events/probabilities.

So I had been willing to hold for a long time on the basis that the platform/technology was valuable unto itself and they would birth more and new blockbuster drugs on that basis.

It’s a long way from being fully vindicated and the stock is still way down from the pandemic highs but it’s an exciting and vindicating first proof point of this thesis. So I’m still long and plan to load up on more soon. Right now it’s not a big position for me but I’m +90% in 12 months.

Thanks to Michael Brown for pitching me on this idea a year ago.

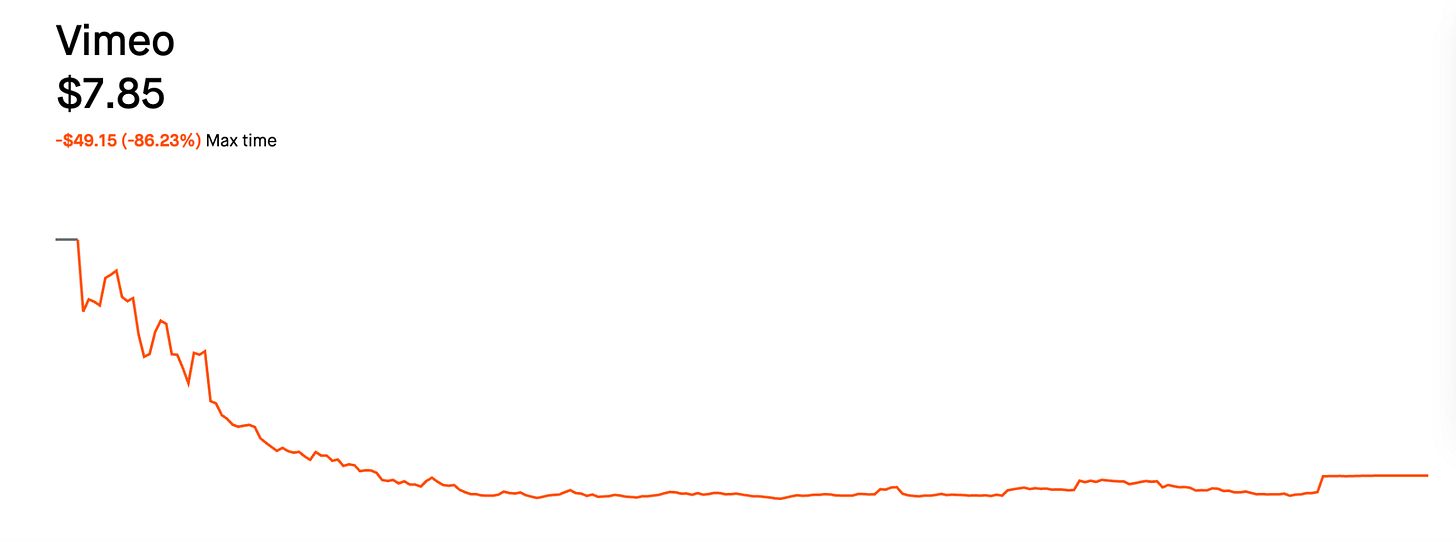

Bending Spoons and Vimeo

Bending Spoons, the European PE-cum-SWE firm that bought Vimeo, is laying off most of the staff, which is sad. A lot of people are mad at them for doing that, which is fair. Bending Spoons is pretty notorious for gutting staff and raising prices. It did prompt some thinking about what has to happen first…

Did PE kill [company]? Rarely. But it bought the corpse in hospice, sold the blood and organs, and charged the family to attend the funeral.

At its best private equity should be our capital markets sin eater: hated but socially necessary, absorbing that which we otherwise cannot.

The best version of PE is managed decline. Buying, running, and extracting value from assets in structural decline won’t win you friends but it is necessary/useful and profitable.

All things end and this is the good and orderly way to manage a business out down to terminal value $0. Sometimes that takes a long time. Sometimes it happens to a beloved brand. But eventually death comes for us all.

The problem is when PE is allowed to run this playbook on critical industries that cannot be allowed to die (healthcare, eg) or when managed decline gives way to “value creation” through consolidation and market power rather than some heroic reversal of fortune and a return to the path. This is profoundly un-American and contrary to the spirit of democratic capitalism; it is a social disease that leads to $400 insulin.

There are social virtues in public companies but not every company can sustain that and every cash flow stream deserves a home. The sad part isn’t that PE bought something; it’s that it was dying and a target for PE in the first place.

The point about Git being built for human-scarce attention and code-abundant workflows is spot on. I've been seeing this friction firsthand with teams using AI code assistants and its creating chaos in the review process. Really interesting to see someone tackling verson control from this angle rather than just adding AI features on top of existing tools.

best testflight ever, for creators and 1099's, on solana :) testflight.apple.com/join/4ZprApsP