The Complexity Crisis

AI will drown the enterprise in complexity + the GIGACYLE is here

AI will drown the enterprise.

As software gets better, enterprise environments and IT systems are going to get way more complex and harder to manage.

Software/AI can do more things ▶️ more use cases

Cost to produce code goes down ▶️ more options/vendors for each use case

Products get better faster ▶️ more features/releases to manage

Collectively, that means the future looks like way more apps and systems from more vendors swapped out more frequently with more and smaller vendors to evaluate each time you do. At the same time, MCP, operator models, etc. create entirely new surface areas and vectors for complexity, integrations, and management.

Everyone who gets paid to manage that complexity will be a winner because rising need and demand:

Integration and abstraction platforms

System integrators (SIs) and implementation consultants

Vendor discovery and management

New takes on SSO/security

I’m excited to back each of those types of opportunities. Let’s explore them individually.

Abstraction Platforms

Every company in every industry has a system of record that winds up as both an app and a database. It’s usually a specialized ERP, but sometimes it becomes so specialized it becomes its own thing all together: real estate (PMS), airlines (PSS), mortgage (LoS), healthcare (EMR), etc.

All the important information and workflow lives within this SoR, so any other apps need to integrate with or go through it. The more integrations and external apps/point solutions companies use, the more locked in they become. These things generate their own gravity.

These ERP-type tools are generally old, kind of shitty, and incredibly complex – often far too complex for any single startup to come in and replace, at least for enterprise customers. They've had years (decades) to build for every imaginable corner case and oddity their clients have presented. It’s feature-complete with high switching costs.

So, companies are completely locked into their SoR with no path out and rising costs (hard dollar and soft): delays/poor UX on the one hand, and IT consultants, integration specialists, specialized tools, high prices, etc. on the other.

But rather than building direct 1:1 replacements, startups should focus on vertical IPaaS or vertical Zapier to abstract away from the system of record and turn it into a dumb database vs a core app and workflow tool.

Sometimes this may even look as simple as an agent that sits between the SoR and the user such that users interact with one interface which then writes directly to the database, at least as a starting point.

System Integrators and Consultants

The new breed enterprise companies/vendors will often be too small to provide the services their customers need (training, complex onboarding, managed run, etc.). And the larger ones still want to offload much of that none-core work.

So even as the cost to build goes down, the cost to market, implement, integrate, etc. stays the same or goes up (more competition). You have to fit together more pieces, each with different interfaces, APIs, assumptions, and dependencies. Mapping alone becomes a beast.

That is ultimately a huge boon to the consultants, system integrators, and VARs who get paid to manage complexity and charge a toll fee for GTM to the vendors and/or implementation and management fees to the buyers.

The consultants and SIs will be beneficiaries on the demand side (already happening - Accenture and similar shops are huge winners today) but also as users/buyers themselves making use of new capabilities. These will always be services businesses, and some end clients will still need more service than code, but much of the work of an SI or implementation consultant can now be significantly accelerated / augmented (generating custom code, mapping data/fields, interviewing users, etc.).

There are going to be a bunch of big companies built around this - either selling software products to consultants/integrators or building/running them as margin-enhanced service providers.

Vendor discovery

If SIs and consultants will serve the top and middle of the market, how will the lower market deal with the same issues around discovery, onboarding, and integration?

Obviously PLG and prosumer works but only for a very narrow band of products and customers. For everyone else and anyone who needs a higher touch/consideration sale, there’s limited options for growth beyond spamming customers with outbound (which won’t work for long).

How do you find and compare options? How do you manage integrations and migrations? How do you find the small consultants to support you? Once you need more than documentation but less than a full blown lift and shift, what do you do?

These kinds of products will increasingly get bought and sold through marketplaces. A software marketplace can support the demand side with discovery, vetting, and compliance; and support the supply side with marketing and onboarding.

You can imagine a more transactional version of deep research that specs products against each other, matches your use cases, and provides some vendor visibility, interoperability, and management.

We'll move from listings businesses (G2 and Capterra never got huge anyway) to transactional marketplaces. Obviously the big cloud and ecosystem companies will be winners here (AWS, Microsoft, Appexchange, Shopify, etc.) but there will be other vertical and horizontal marketplaces that become end-to-end discovery and implementation hubs.

Identity, SSO, and Security

This one is pretty obvious, but as you’re provisioning access to way more things and managing way more apps, your SSO provider winds up in a unique position to do more than just basic access management.

With hundreds of agents and apps per company, your SSO provider becomes the map of who’s using what, when, and how. Whoever owns that map controls onboarding, offboarding, audit trails, risk scoring, and more. And they're in pole position to be:

the security layer for non-human access management (agents, MCP, etc)

an integration service between the apps themselves once credentialed

on/off boarding not just users but vendors (spend management)

At the same time as the need and market opportunity opens up, agents might also make it easier to compete with SSO incumbents. You can imagine standing up an Okta competitor more easily that uses operator models to just sign in for your without needing direct integrations.

Similarly, AI-first SSO could roll continuous, proactive monitoring. Instead of quarterly access reviews and manual logs, your IAM layer could continuously monitor policy drift, surface shadow accounts, and generate audit artifacts on demand.

The demand is gonna get there for way more and way more powerful SSO/access management at the same time as the technology creates a market opening.

So What?

AI will obviously make it easier to build software. But for it to actually be valuable to customers it needs to be fully usable: discoverable, installable, configurable, and manageable. As the cost to produce code and deploy agents goes down, the challenge of managing it all will go up. To the managers go the spoils.

These are the opportunities I want to invest against. If you’re building in, around, or on top of that mess, let’s talk.

The Gigacycle Is Underway

Venture Buyouts are an asset class now.

At Slow we’ve long believed that some founders/companies will be better served buying/owning/operating companies directly rather than selling to them. If you sufficiently transform the earning power, keep the upside.

We've been working on this strategy for years (starting with Metropolis and Teamshares) and now it's clear/finally a thing. Lots of people are doing it and literally everyone is talking about.

Despite the mania and noise, it's a real thing.

Software has matured and there are no moats on code

vSaaS is tapped out and "selling work" has a ceiling on ACV

Capital markets favor control and value capture

Founders want leverage and independence

Plus, it has undeniable sex appeal. Thus begins the Gigacyle. But there are still immutable laws of gravity and startups that apply here:

Let the main thing be the main thing: Product (not process) must still be your edge. Be pareto efficient

Start with software: Build first. Validate with customers before you scale (by buying).

Do big deals, not fast ones: The soft transaction costs (source, diligence, finance, integrate, etc.) don't scale linearly. Amortize them on big deals or treat lowering them as your core product. Avoid SMBs.

Use debt: duh.

As Will put it, you have to limit yourself to one miracle at a time.

Nearly all of the "roll ups" (high velocity, small deals) and venture-funded PE execution plays (we're smarter/better operators) will top out because transactions themselves are hard. Respect the laws of gravity.

Focus on value creation first. Go big.

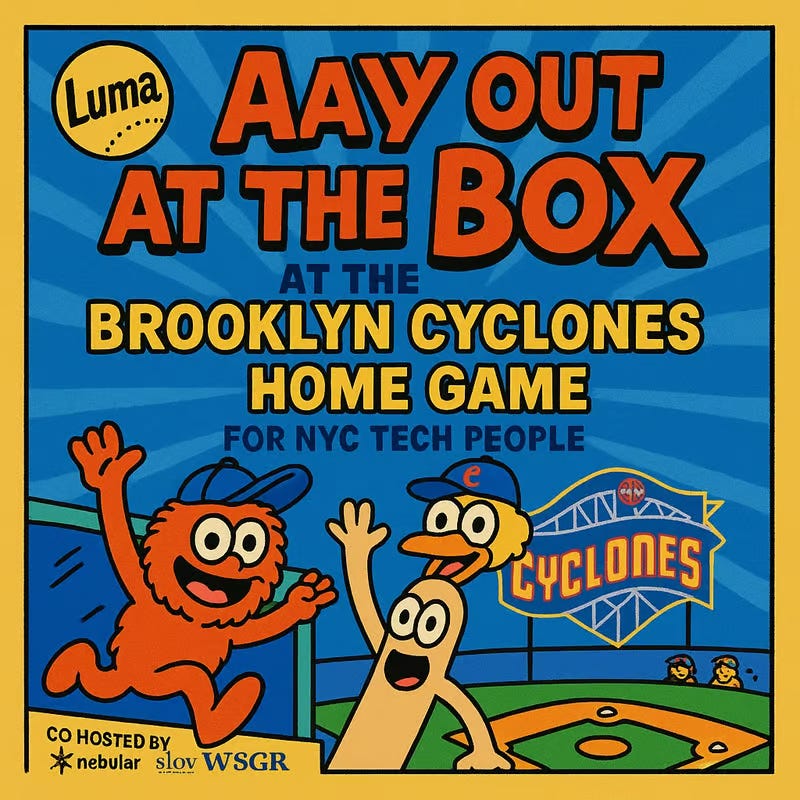

Baseball!

Finn and I have a box at the Brooklyn Cyclones for founders and operators on Thursday June 12. We'll take in some top notch (minor league) ball with dogs, beers, and maybe a roller coaster ride. Everyone gets a free hat and an elite NY experience.

Abundance Voter Guide

Abundance NY has released its 2025 voter guide.

New York is in crisis. Our rents are rising, our infrastructure is crumbling, and our streets and subways feel less safe.

On June 24th, New Yorkers will vote in our primary elections to choose party nominees for offices from City Council to Mayor. The officials we elect have the power to shape how safe, affordable, and livable New York is. But voter turnout is low, and high-quality information is hard to come by.

This Voter Guide highlights a set of competitive, high-stakes races. It is meant to empower readers to make informed decisions and recommends the candidates most likely to move the city forward.

While this voting guide doesn’t PERFECTLY line up with my own (I’m not ranking Whitney Tilson) it’s generally a great resource.