The VC x PE Supercycle

More on the future of venture, an ambitious housing plan for NY

Whether it’s PE funds buying venture backed companies, venture funds launching PE strategies, or startups using PE-like approaches to buy their customers, something big is going on.

There's four separate but related things happening at once that are driving PE and VC inexorably closer together.

Category maturity/legibility: As software has become now fully legible (easy to model and underwrite, broadly understood, ample playbooks and exec talent), it's just another low growth category for PE to buy and fix. So while "let's buy stalled software companies and turn them into cash flow machines" is not a new trade it is increasingly popular one (if hard to pull off).

Limits on growth. As pure play (application) software hits limits on growth and adoption in the real economy, companies are looking for new ways to deploy their products. ~Buying real businesses and transforming them with software is just a different business model (value capture) for the same basic products (value creation)~ we've always seen.

Asset class maturity. Because of the massively increased AUM multistage funds over the last few years "just do private equity" is becoming a hot trend for VCs to just deploy big dollars. The megafunds are becoming multi-strategy platforms that do all things for all people just like the multi-manager hedge funds, bulge bracket banks, mega PE funds, etc. They will raise dedicated PE vehicles to sit next to their minority growth equity funds.

Entrepreneurial culture. Founders are increasingly keen to control their own destiny and find faster, more efficient paths to profitability and independence. At the same time, everyone not high on the AI supply is building for the real world/real economy. Naturally that steers founders toward these new, hybrid approaches to buy, transform, and own real businesses rather than building software for software companies or trying to sell products to markets that don’t want them.

This is the early innings of a new supercycle that will shape the structure of technology companies for the next decade or more.

Even More on The Future of Venture

What’s the future of venture? Charles Hudson lays out the three possible futures as most people discuss them:

Return to the status quo of small funds doing seed and multistage doing the rest. Unlikely.

Bifurcation - same industry, different business models - whereby there are small underwriters doing weird stuff and big asset managers pumping dollars.

“Big fund hegemony” where the biggest funds suck up all the LP dollars and opportunity.

Clearly #1 is not happening (everyone agrees, including Charles).

Beyond that, I don’t really see #2 and #3 as being meaningfully different.

Multistage will absolutely dominate a certain subset of the seed market (they mostly already do). So it’s a question of when, not if multistage will back winners.

Big funds operate at scale. So they need legibility and credibility, they are in the business of winning, not parsing. This is especially true at seed where they’re building/buying a basket of call options rather than backing specific companies indepedently. After all it’s just lead gen and cookie licking for them.

Companies are either extrinsically legible (founder came from Stripe/Anduril/OpenAI, did YC, sold a company before, etc.) or intrinsically legible (the business is crushing).

Multistage firms will always back companies at the first sign of legibility. So the job of seed specialists is to invest early and help illegible founders/companies become undeniable.

Whether or not we ultimately make money on 1-2B outcomes or 5-10B outcomes is immaterial. Obviously we can make money either way (the handicap only applies to the megafunds) even if we should pretty much never back something that DEFINITELY CAN’T be a public company.

Abundance

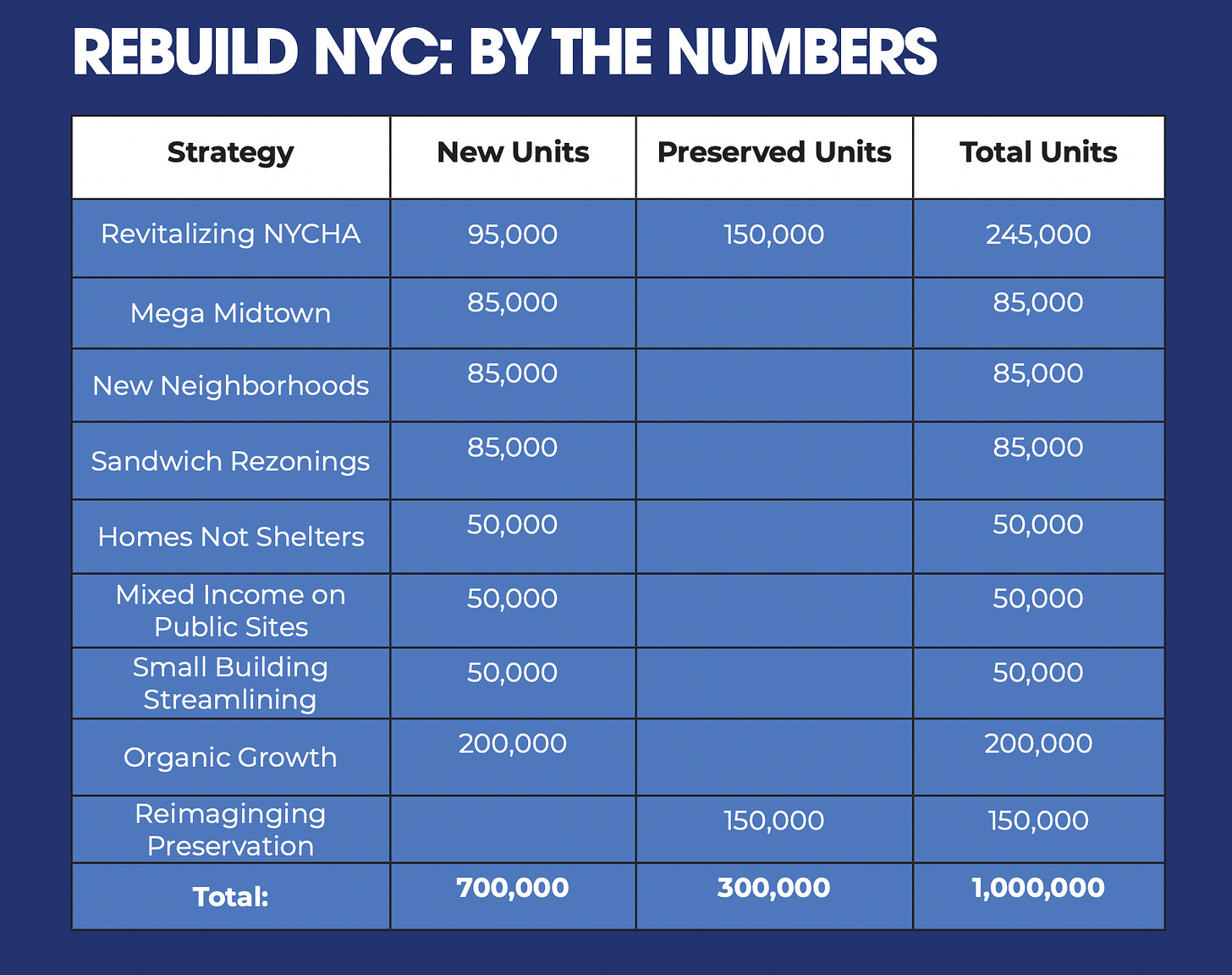

NY State Senator and NYC mayoral candidate Zellnor Myrie released his a 26 page housing plan: Rebuild NYC - A Mandate for One Million Homes.

This is awesome for two reasons. First, having a genuinely YIMBY candidate should help highlight the issue and move Overton window. Second, a candidate so clearly oriented around detailed policy plans is just a great sign for governmental competence. As of now, Zellnor and Comptroller Brad Lander are my two top choices.

Love to see this level of ambition from government.

My buddy Justin is doing an event in Brooklyn in a couple weeks that I am sadly missing. You should go!

Building the world of our dreams has never been more attainable than it is today. Our society is the wealthiest, most knowledgeable, and most technically advanced in history. Yet, why does so much of the modern world around us feel dispiriting?

Join Linear for a celebration and conversation on Coby's new book, Building Optimism, where he explores why our cities and communities look the way they do and shares some ideas on how we can make them better.

For my part, I’m planning an event for January. If you want to be in the loop and contribute to making the abundance agenda for NY happen (housing, transit, good government, public safety) let me know. More to come.

I Read

A great longpost on venture fund portfolio construction/theory from Dan Gray who has been my favorite recent follow on Twitter. At some level the basic debate is whether or not portfolio construction matters in a power-law-distributed asset class. You have to even buy into the premise before you can debate strategies so Dan is fighting two battles at once. I believe in what I’ll call “weak form portfolio theory.” That is, of course it matters but of course it matters much, much less than having good names in the portfolio and there are rapidly diminishing returns on trying to model to precision when you’re sitting on a basket of dogs.

What Happens When US Hospitals Go Big on Nurse Practitioners. This is the next part in a series from Businessweek. Getting more NPs is obviously a good idea but it’s also obvious that PE hospital owners will take things too far AND that there needs to be more standardized training requirements. So don’t assume that nurses are the problem as much as healthcare consolidation and

MGMT claim 'Kids' is "the most stupid song possible" I’m sure people saw the video of MGMT performing Kids from 2003. It rocks. Apparently the song was written as a joke!

ADHD, Conscientiousness and Will Power - Vaishnav Sunil on Substack.

Who doesn't love a politician with a plan, especially regarding affordable housing? We can't have this conversation without considering its impact on gentrification. Neighborhoods like Bedstuy and Flatbush are already dealing with this, and policies must go beyond producing housing. They must address the risks of displacement and cultural erosion while ensuring that long-time residents benefit rather than bear the development costs.

I'm happy to help with the event in January if you need someone to capture content. I own a couple of Canon cameras that I can use to film and take photos.

Count me in for wanting to make the abundance agenda happen! 🤝