Martin is right about "non-consensus"

Martin is right actually, Heave's $13M funding, and previewing our October conference

The big brouhaha on twitter this week was about the idea of consensus investing. It was very exciting for everyone to talk about how contrarian they are.

a16z Partner Martin Cansado set it all off by tweeting:

Taken at face value, this is obviously insane advice. Founders and (especially) investors benefit from lack of competition which only arises from non-obvious, non-consensus ideas.

Even great ideas become bad bets (founders too) if they’re too obvious and attract too much competition.

It’s also self-fulfilling in that it assumes the constraint is downstream capital, which is always true if you invest in competitive markets with obvious businesses.

As Miles Dieffenbach pointed out, OpenAI was non consensus in 2019, Google non consensus in 1998, Airbnb non consensus in 2008, Palantir non consensus in 2003. The list goes on but the point is obvious and clear.

It’s also worth noting that this is the exact same thing a16z partner Andrew Chen said in Feb 2021, around the same time he invested in Clubhouse at $3B. Then as now the signs are signing.

Anyway. All this “consensus and hype is bad, actually” is pretty obvious and rote by now even if it’s true in some abstract sense. Worse, it’s cheap to say and hard to do (well). In effect, everyone was seeing and saying basically the same thing disconnected from action, full of sound and fury signifying nothing.

And worst of all, it doesn’t actually address the point that Martin is making. He later clarified:

I'm much less interested in whether consensus based investing works. And much more interested in the dangers of being non consensus […]

I actually believe the following two statements are roughly true (a) VC consensus is often hype driven and totally disconnected from markets (b) early markets are efficient and therefore good deals get identified early and that's reflected in marks. In other words, deal hunting is the wrong approach in VC

This is totally true! It’s true that investing truly outside the consensus creates brutally hard follow-on capital risks (to be non-consensus you may need to be big enough to take stuff all the way yourself). And it’s also true that markets are increasingly efficient, which means if you’re consensus you’re probably wrong. It is extremely rare to the sole bidder for genuinely good things.

If you can’t acknowledge those risks, you certainly don’t have the stomach to take them!

Finally, looking for “deals and steals” can be a very dangerous idea at seed. I call it “shitty Series A” investing, where you just do bad things, often with some traction that won’t scale.

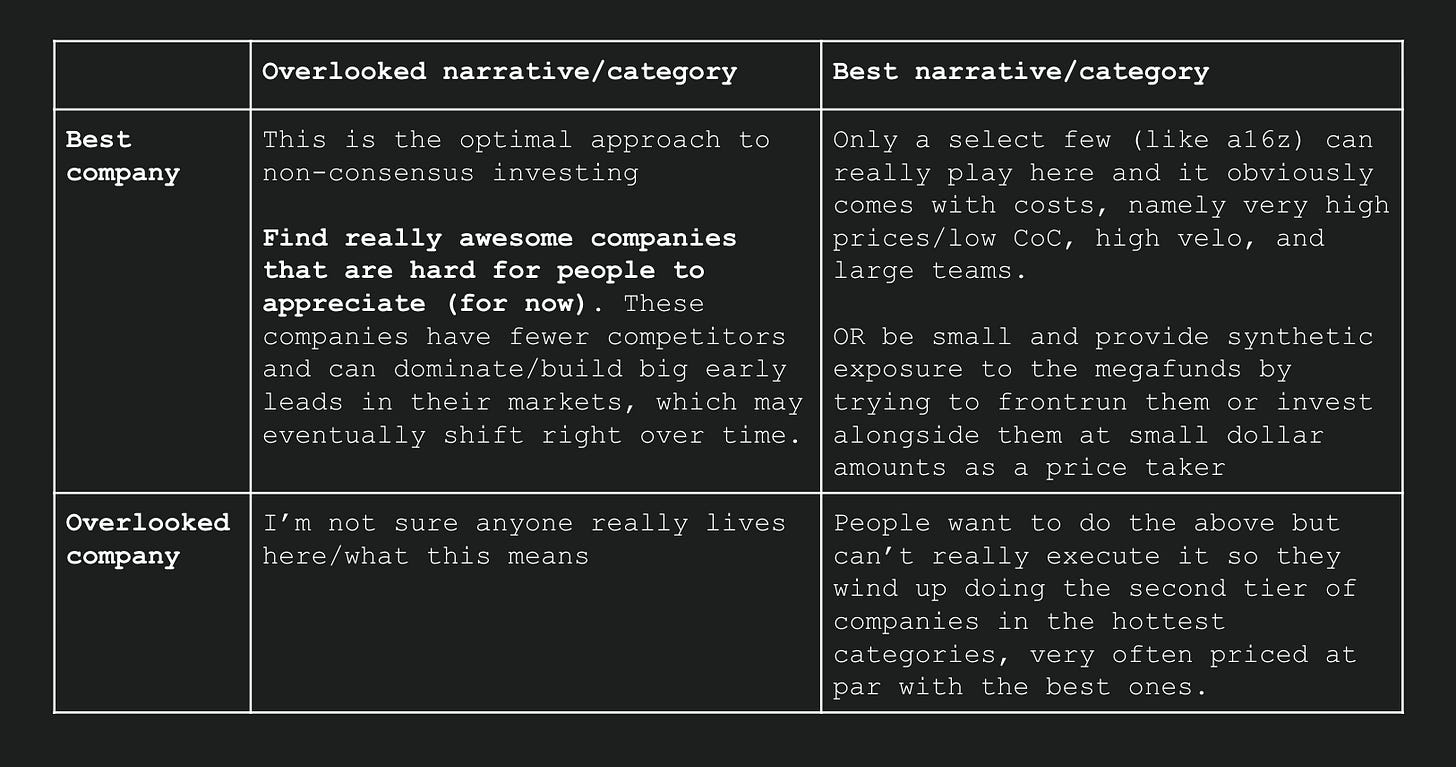

I think it’s better to think about non-consensus narratives that are overlooked rather than betting against the crowd outright or finding "undervalued” companies. Here’s how I think about things instead/for my part:

This is why I distinguish between “contrarians” (betting against others, like shorting a stock) and “non-consensus” (betting where others simply aren’t). I want to find the best founders and the best companies who are early to weird little narratives that might wind up being really important.

And while Slow isn’t huge, we’re big enough to fund our companies a good bit of the way there even if the market doesn’t believe with us.

But dunking on Martin based on a missed interpretation of what he actually said doesn’t make you look special, it makes you one of many.

Heave Raises $13M

In October I wrote about why repair and maintenance is a great wedge into big markets. It was a preview of a company we’re really excited about.

Repairing complex, expensive equipment is a super elegant way to get into industrial workflows efficiently and build a many-armed tentacle monster.

Many shots on goal: Unlike equipment sales which happen infrequently, repairs are ongoing. They might not always be in the market for a $50k backhoe but if you call a big asset owner to ask if something is broken the answer is always “yes”. You have a lot more chances to win big customers (better CAC/GTM). Great land and expand motion.

Motivated buyers: unlike buying a new vSaaS or SOR, repairs are urgent. When something breaks it needs to get fixed right now. So customers care about the problem and are already used to paying to solve it.

High value: Unlike single use supplies, machinery and heavy equipment is high value and fixing it is high skill - not just a question of price. It’s a hard problem to solve otherwise and the dollars

Now Heave is announcing $13M in cumulative funding to power heavy equipment service. We seeded the business with Long Journey Ventures and FJ labs. Now Outsiders Fund just led a new $7M round.

This is a super cool, unique business. Heave is a marketplace that connects independent technicians with heavy equipment fleet owners. These are huge, complex, incredibly expensive pieces of machinery and right now getting them fixed is a huge hassle because it’s not really a revenue driver for the dealerships compared to selling new equipment.

Heave gives the technicians the ability to go solo and provides fleet management tools to its fleet customers for faster, better, cheaper service. This is how useful AI gets into the built world/heavy industry and makes long tail entrepreneurship more possible.

There are techs on Heave clearing over half a million in annual income. The company is live across Florida, Texas, Atlanta, Charlotte, and Nashville.

CEO and founder Alex Kraft is a beast. He’s been in the construction industry for a decade and came into tech to build this company. Born to do this work.

Conference

In May we hosted Slow Summer in NY, our annual mini-conference for young partners, principals, and emerging managers headlined by a fireside chat with Fred Wilson. Now we’re bringing it back back in October in SF and have a stacked line-up starting to take shape. We’ll have discussions around starting new funds, the present and future of the asset class, how that will drive/shape our careers, etc.

This is a pretty tight group and an intimate event but since you’re reading this/are a subscriber, I trust your judgement and would love your referrals 🙂

You can read more about the NY version here.

I Read

LLMs, IT Services, Rollups and the Hype. Rudy who wrote this is a buddy in India and I think very sharp on the idea of IT services rollups. He calls out what I think is the most important piece of this: Before buying any business to “AI transform,” founders must first build a real product (or suite of products) based on live customer use cases..

Trust by Hernan Diaz I liked this novel. Diaz uses memory, story telling, and unreliable narrators as a really clever device to tell an interwoven story in four parts all centering on gilded age and jazz age financial markets. It’s a real New York City book and, as a parochial New Yorker, I particularly liked the parts set in my childhood neighborhood Carroll Gardens.

AI broke job hunting. I think I have a fix. This has been a particular bugaboo of mine the last year. I don’t know that randomization is really a practical/palatable solution in a real workplace but it’s fun to think about.

Martin is stating the obvious - the optimal seed strategy is to be non-consensus at seed but have the portfolio company attain consensus by the time it reaches Series A. Why is this controversial?