Happy July 4th from Vermont! I’m definitely glad to be out of the city for the 4th this year. Even as there’s quite a lot to be sad and frustrated about in our country right now (the OBBB is just more regressive, decel, fiscally irresponsible nonsense), I find a lot of comfort in the idea that ‘there is nothing wrong with America that cannot be cured by what is right with America.’ The uniquely American spirit of optimism, humanism, and pluralism will prevail. On to the content.

Even Cracked Kids Grow Up

The current meta in startups is cracked kids. The younger and twitchier the better. Youth has been in since Facebook at least but now everyone wants to find the next “AI native” founder. And the consensus is that youth will translate to fluency/speed in era where velocity is everything. It might be right!

On the one hand, the narrative is great because it’s opened doors for talented young people to take big swings commensurate with their ambitions and do stuff that they wouldn’t otherwise be able to.

Young people are getting taken seriously as builders because they have some real advantages (energy, flexibility, availability) that can sometimes compensate for lack of experience, connections, etc.

But it also reminds me of a particular risk/problem I noted at the height of the “Gen Z VC” thing a few years ago. In 2022 I wrote:

If your plan is to be valued within your firm primarily for your youth (or plan to get a job on that basis) you're eminently replaceable, increasingly so as you age. You are setting yourself up as a piece of marketing for the firm, not an investor. Youth is fine as a calling card when you have nothing else but it has to be an entree to developing something durable and unique.

Young founders will never go out of style but eventually this meta will end and some new archetypal founder will pop up. Eventually Michael Truell will be 30 too. He’ll have built Cursor - what will you have done?

I worry for those wrapping themselves in the flag of youth as so central to their identity. If your identity and value is being young, what happens when you're not? At some point, the story will shift to what you built/can do - take it from a guy who got old(er)!

H/t to Graham Carney for the inspo here.

Soham Parekh

ICYMI the big meme of the week was that one software engineer in India had managed to get jobs (and get fired from) dozens of startups simultaneously. He’d reach out, absolutely crush the interview process, not really work (too busy interviewing elsewhere) and see how long he could collect a paycheck before getting fired. Read more here.

The Soham stuff is obviously funny/great fodder for jokes. But there’s two real things in it.

It holds up a pretty damning mirror to the hiring and management practices at most startups. That the system was this hackable by a bad actor and someone got away with it for so long says pretty clearly that getting the job has become a skill unto itself divorced from doing the job.

It is a portend of what is coming for hiring and job markets overall. Soham is clearly clever and motivated but he is not a one-off. As the transaction costs for job applications go down, the systems stop working and become unmanageable. AI is making this a lot worse already with a second shoe ready to drop.

None of this is super surprising. In Feb I wrote:

AI-powered scale will make labor markets murkier and less efficient (more work for worse outcomes). Competition, infinite/global markets, sophisticated automations, and unsophisticated slop are going to kill performant channels.

Unlike sales, hiring is bidirectional and so the problems (and solutions)will be bidirectional as well.

Talent (supply) is increasingly bombarded with low quality inbound that is hard to parse. And hiring managers (demand) are overwhelmed with impossible to distinguish candidates. This is true up and down the labor/income ladder.

In the AI era, how do you source and parse talent?

Trusted sources and networks. Referrals and reputation will win.

Quality and skill assessments over resume screening.

High transaction costs. “Common apps” induce more, low intent demand which leads to quasi-random placements and a less efficient matchmaking process with sub optimal outcomes. Transaction costs reverse that.

And how does talent vet inbound and prioritize outbound?

Trusted sources and networks.

Talent agents in any non-permanent market (like nursing or trades). The “staffer in your pocket” will book the best jobs, instantly apply, and earn more. Don’t talk to recruiters.

Just like sales, hiring will be all about reputation, network, and authenticated attention versus mass campaigns. Spamming candidates and jobs won’t last as an efficient or effective SOP. The optimal outcomes won’t be scaled, anonymous, and efficient but hand to hand and trusted.

The age of inbound is coming to hiring.

Soham is a symptom of systems that are too easily hacked and broken by brute force.

I Read

As AI Infiltrates Call Centers, Human Workers Are Being Mistaken for Bots. I strongly suspect that the EU will require AI disclosure and a “right to speak to a human” within a few years. The US probably won’t do the same (maybe disclosure).

That Dropped Call With Customer Service? It Was on Purpose. More call center takes on the ways that companies incentivize frontline workers to create administrative and operational barriers in the hope that you’ll just give up.

For some people, that humanity gets trained out of them. For others, the threat of punishment suppresses it. To keep bosses happy, Tenumah explained, agents develop tricks. If your average handle time is creeping up, hanging up on someone can bring it back down. If you’ve escalated too many times that day, you might “accidentally” transfer a caller back into the queue. Choices higher up the chain also add helpful friction, Tenumah said: Not hiring enough agents leads to longer wait times, which in turn weeds out a percentage of callers. Choosing cheaper telecom carriers leads to poor connection with offshore contact centers; many of the calls disconnect on their own.

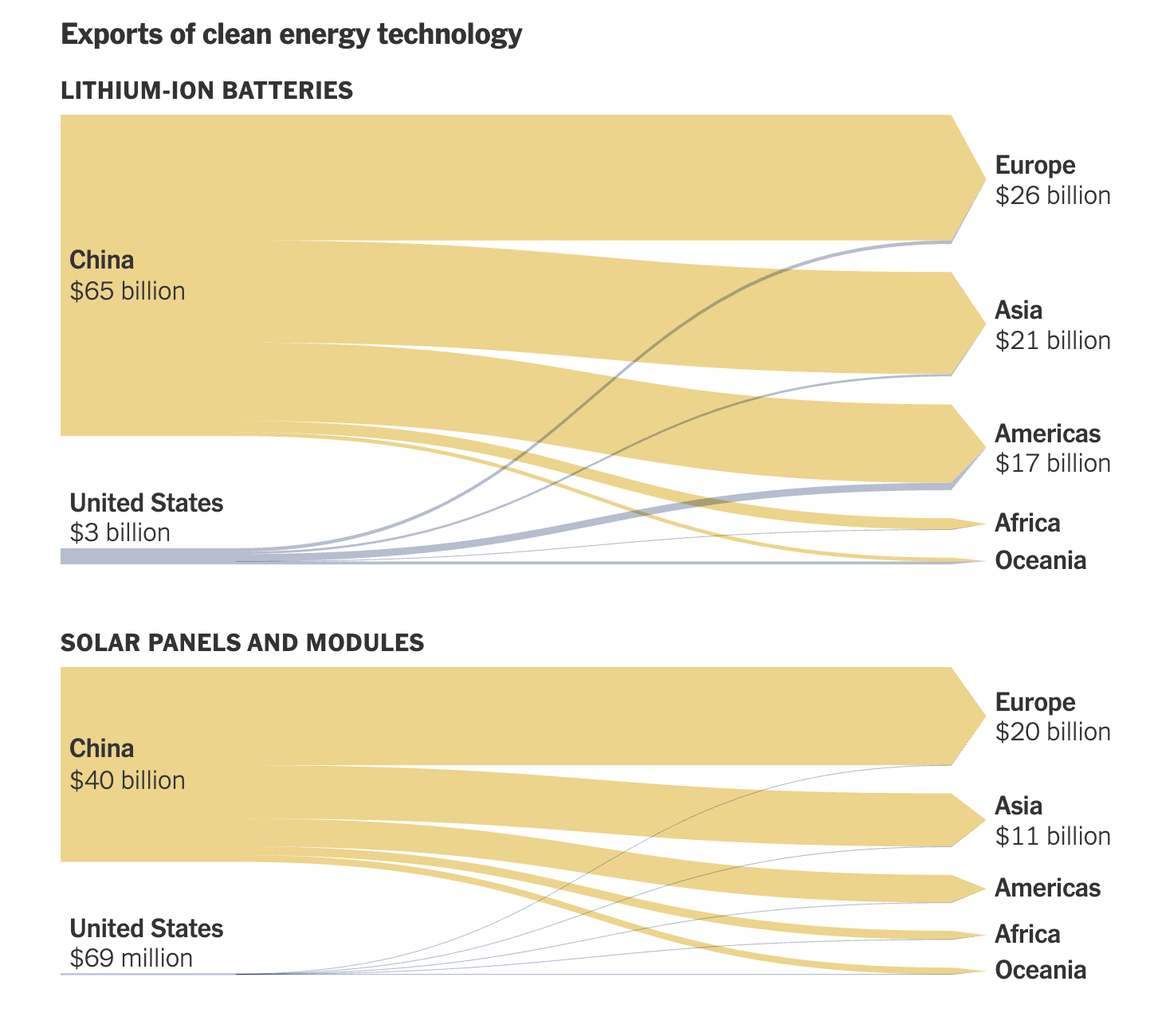

China's Clean Energy Boom Could Win the Race to Power the Future. This is just so damning. The US is ignoring the technologies of the future and committing to a path of expensive, dirty energy while also ceding soft power and influence to China. As I’ve said before, Trump is a degrowth, decel, anti-abundance president.

‘Thrilled’ California Developers Cheer Rollback of State’s Environmental Law. This is shit headline. What happened is that CA has expanded by-right permitting for infill development in urban areas. This is just great news on the housing front and should, over time, be a meaningful lever to drive down housing prices in the state.

DraftGPT: The Brave New World of AI Hits the NBA - The Ringer.

Teams have begun incorporating machine learning into their player evaluations, including to scout this year’s draft class. One model even claims to be able to predict NBA success based solely on player sound bites.